Argus Media

•

7 March 2024

German February gas demand falls | Latest Market News

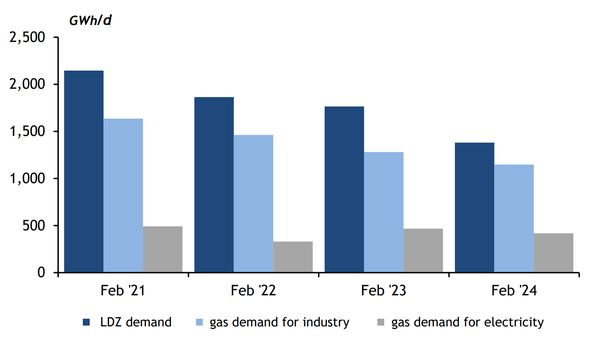

German gas consumption slipped year on year in February for the third year in a row, driven by mild, windy weather.

German consumption was 2.96 TWh/d in February, down from the three-year average of 3.82 TWh/d.

The average German temperature was at an all-time February high of 6.6°C, far above the 1990-2020 average of 1.5°C, according to German meteorological agency DWD. This weighed particularly on demand from households and small businesses, which fell to 1.38 TWh/d in February from 1.77 TWh/d a year earlier (see graph).

And gas demand from industry fell to 1.16 TWh/d in February from 1.28 TWh/d a year earlier, according to Argus estimates. Mild weather curbed demand from industrial users too, while manufacturing output has maintained a downward trend. It is unclear to what extent industrial activity will recover in the coming months on the back of lower gas and power prices.

Gas demand for power generation also fell, to just over 420 GWh/d in February from just under 470 GWh/d a year earlier, according to Argus estimates. But this was higher than 330 GWh/d over the month in 2022. Wind power generation was 24GW in February, up from 18GW a year earlier but down from a particularly strong 31GW over the month in 2022.

Argus estimates German power sector gas burn using electricity generation data published by Entso-E and an estimated efficiency rate based on monthly fuel use data published by Destatis. Market area manager THE only publishes combined demand from the power and industrial sector.

Power sector gas use may rise in future

The phase-out of coal-fired power plants by 2030 coupled with a slowdown in renewables additions could support Germany's power sector gas demand later in the decade.

BMWK said last month that it would "shortly" tender for a combined 10GW of hydrogen-ready gas-fired power plants, although this was down from plans to tender 23.8GW in August last year.

While the coal phase-out may lift the call on gas-fired plants, renewables raising their share in the power mix will cut into overall thermal generation. German wind generation was 24GW in November 2023-February 2024, up from 16GW over November 2020-February 2021.

But German net onshore wind additions were muted at 2.9GW in 2023, bringing onshore capacity to 60.9GW. Despite an 80pc increase in permits issued in 2023, 8GW of capacity is approved and waiting to be implemented.

German power demand remained level on the year at 56.7GW in February, but was far below 63GW in February 2021. The installation of heat pumps and electric vehicles should boost power demand in the coming years, according to German regulator Bnetza.

By Chris Welch